The Money Campaign: The Alibris IPO Roadshow

What is an IPO roadshow like? And what happens when it all goes wrong?

By 2004, American stock markets had replaced commercial banks as our most important source of corporate financial capital (today it would be private equity). At that time, about 15,000 companies worth trillions of dollars sold shares to the public. Public companies have always lived under the scrutiny of the Securities Exchange Commission, whose first Chairman, bootlegger, and presidential daddy Joseph Kennedy, Sr., knew a thing or two about the manipulation of public capital markets.

A company that wishes to raise capital by selling its shares to the public undertakes a highly formalized ritual known as an initial public offering or IPO. For a fast-growing technology company, an IPO is a coming-out party worthy of a Texas debutante. For a CEO, an IPO is a right of passage.

In 2004, I attempted to take a small company public shortly before the Google IPO, one of the largest and most visible public offerings ever. Our offering failed - a humiliation at the time, although as it turned out, it was not such a bad thing.

The reasons for the failure are partly fundamental (Alibris was too small to be a public company), partly technical (our lawyers and bankers made some boneheaded decisions), and partly financial (thanks to optimistic and generous private investors, we ended up not needing to accept pricing that we did not like).

Preparing an IPO takes a year of intense work. Attorneys, investment bankers, and accountants prepare detailed documents for government review. The collective billing rate for these rooms full of nice suits frequently exceeded $10,000 per hour (excluding the bankers, who get paid more if and when the deal closes). Our company, which sells used, rare, and out-of-print books to consumers and businesses via the Internet had less than $10,000 per hour in revenue - and no earnings to speak of. Documents emerge from these meetings that give the public a complete, if turgid, picture of the company, its markets, people, and financial condition.

To go public, a company puts on its Sunday finest. Boards quickly adopt policies worthy of grown-ups: how do we protect whistleblowers? What is our code of ethics? (Bring on more lawyers, since "No cheating" no longer suffices). Should we reincorporate in Delaware, whose courts are a wholly owned subsidiary of the stock exchange? (Easy decision. Yes).

The SEC attorneys who review these documents are no fools. They assume that anyone raising public capital is trying to shill an impoverished widow out of her last dollar. In truth, we will be attempting to shill large investment funds out of a tiny fraction of their dollars -- but the disclosure requirements are the same.

The roadshow begins once the SEC approves the draft prospectus, or "Red Herring". The CEO, CFO, and investment bankers visit prospective investors. The roadshow is an intense, surreal journey of over-scheduled days that resembles nothing so much as a politician's whistle-stop election campaign. The purpose of the campaign is money - for a company and eventually for investors.

Our roadshow took place in early May 2004. Each evening, I emailed home private notes to our board and employees. When I wrote these notes, I could not publish them. They violated strict SEC "quiet period" prohibitions against any communication they had not approved. I have updated the diaries slightly and redacted most names. Doing this eliminated many references to our bankers, lawyers, and colleagues - especially Steve Gillan, our CFO, and Brian Elliott, then our COO. This is fair, insofar as they in no way endorsed my musings, but it gives the incorrect impression that this IPO was a solo effort. It was not. I happily acknowledge and appreciate their huge contribution to this effort - although errors in these notes are mine alone.

Day One: Rockin'

Friday, May 7, 2004. London

Team,

Six meetings and a rock concert for a total of seven high-quality events.

The meetings do not vary. Enter car on left, zoom to office building, clear security, elevator up, exchange business cards, pass out Red Herring. Pitch using portable flip slides --- no computers. Answer questions. Run to car. Find caffeine, rinse, and repeat. At end of day, stare at the collection of business cards, try to remember who was which, and speculate as to who might want to buy some stock. These are small, personal, face-to-face meetings. It is a massively inefficient process. Like politics, all IPOs are local.

Brits are chronically polite, which makes it hard to tell whether you are persuading them of anything or not. We have been assured that in New York and Boston, we will not face this challenge -- when they smack you on the side of your face with the S1 and walk out, it is a clear signal that they are not buying.

There is, of course, a language barrier. I'm sure that the problem is worse in Texas, but the tongue gets a bit twisted here (favorite sign today warning of speed bumps near Waterloo Station: "Continuous humping, next 100 yards"). When we say turnover, they hear sales, not asset efficiency. We smile and pretend to understand each other, the way everyone does in foreign countries.

I called in an amazing executive perk today. All of the documents related to the IPO are printed by highly specialized financial printers. These companies specialize in accurate, fast printing of prospectuses and the like. They are expensive and appear to compete not on price but on their ability to score tickets for the CEO (they were visibly disappointed to learn that I was not a big football fan).

This morning we noticed that a concert was taking place in London near our hotel. It had been sold out for months and the local concierge assured us that tickets were a complete impossibility at any price. So we placed a quick call to the printer back in Silicon Valley "uh, I know this is short notice, but…".

This evening from an exquisite box in Royal Albert Hall, we watched a guy who, back in the late sixties, had been the subject of a rash of graffiti in London, a man who changed bands almost yearly but had a remarkable way with an electric guitar. The spray-painted signs said simply "Clapton is God". We found evidence tonight to suggest that this assertion may be true. In any language.

Marty

Day Two: Stretchin'

Monday, May 10, 2004 California Bay Area

Alibrians,

Day one of the domestic roadshow began with an incessant pounding at 5 am. I was mainlining espresso in the kitchen, still in my undershirt, hoping to preserve the purity of the power tie on white. As the caffeine slowly took effect, I realized….knocking at the front door... music from outside... blond driver dressed entirely in black.

"Hi. I'm early. I hope I didn't wake everyone" announces a white head suspended against a black porch.

Need more caffeine.

"Uh, it's OK - but turn down your car radio. The neighbors don't like Daido this early." Dress quickly, kiss wife, lock, and leave.

Too late. The neighbors are staring through windows at my ride, a limo that seems to stretch the full width of my front yard. Flashing pink neon lights above fake whisky decanter inside. Not practical. Not smart. Not pleasant - especially when I imagine the drunken prom dates that precede me.

Caffeine stop at Peets in San Mateo in time to start the first meeting at 6:45 am. Fund Manager, approximate age 14, gets us off to a strong start by kicking out the investment bankers. I decide I like this guy, so I wind up and pitch.

Then the trouble begins. He is dozing on me. Need more caffeine. When people I am speaking with start to fall asleep, I frankly get a little desperate. I try raising my voice at odd moments, like a besotted blogger or a frantic tourist. I emphasize random points ("Ingram. Let me tell you about our Ingram Program").

It's not working - I'm losing him.

I recall my first real boss, a restaurateur named Bill Milhous in my hometown of Whittier. Cousin of our 37th President, who grew up down the street. Now and then, a customer dining alone would fall asleep after a couple of glasses of wine in the comfortable booths of the Seafare Inn. A strict Quaker, Bill would never wake a customer up. At about 11 pm, he would send the staff home, grab a paperback, settle in, and read until the customer woke up. Reportedly this took until 2 or 3 in the morning on more than one occasion. One might imagine a customer dying instantly from embarrassment - but knowing Bill, he probably just smiled and helped the customer to their car. This experience ran through my mind as the teenage fund manager started to fade.

I am not as patient a man as Bill Milhous. So instead of rousing my victim, I quietly began inserting the word "Google" very softly at random moments in my spiel ("With the proceeds Google of this offering, we expect to Google grow our market"). I may be stretchin' a bit, and anyway, I doubt that the subliminal message worked - although our guy did seem refreshed and he had a large grin on his face as we shook hands and departed.

Not a strong start - but hey, there is always another investor to pitch. This time, we prepare.

Me: "OK, tell me about these next guys".

Banker: "Very savvy, high quality, tech investors. They do their homework, so expect tough questions."

Investor (5 minutes later): "So are you guys a book company? 'Cause I don't have time to read books, I only watch TV."

It turns out that an IPO, like more conventional forms of romance, is a volume business that requires a lot of frog-kissing.

Meeting three. Smart investor. Understood e-commerce, understood Amazon. I was about to unveil my Levi-Strauss theory of used books ("this category is so hot, publishers are gonna print 'em to look used when they are brand new - like blue jeans"!). Blessedly, our time expired.

Meeting four: fine. These guys asked why the used book market was growing so quickly. I explained that it was because books work just as well the second time. Like Levis.

Lunch. Pitch a group of a dozen investors. Good questions. Nice broccoli. Snuck back to the stretch before colleagues or board members could photograph me wearing a suit.

Meeting five, strong. Meeting six, great. Stretch to airport. Fly, stretch to hotel.

Need more caffeine.

Marty

Day Three: Flush Until Water Runs Clear

Tuesday, May 11, 2004. Southern California

Team,

When exactly did bottled water become the business beverage of choice on planes, in meetings, cars, and hotel rooms? We are drinking water constantly and, when trolling for capital in La Jolla and Santa Monica as we were today, watching oceans of it out the window.

Each meeting begins with the ritual offering of the water and the presentation of cards. Each ends with a focused search for indoor plumbing, brief ablutions, and a hunt for the next investor.

Six more meetings today. Two with highly distracting views of the Pacific; and two with significant art collections. A well-flushed, smog-free, fog-free day.

Today's second meeting took place in offices that fairly shouted "bad news". Tanned traders dressed in full Tommy Bahama sat behind dual flat panel monitors surrounding a glass-walled conference room with a giant TV screen inside. The screen broadcasts real-time market data. It was six feet high by eight feet wide and split to show CNN, Bloomberg, stock charts, and a streaming ticker tape across the bottom. A live spreadsheet showing the status of funds and momentum indexes was continually updated across the top. (Momentum indexes are a big clue: traders who use these are betting less on the company's results or fundamentals than on the direction of its stock or business metrics during the past days or weeks). The guys staring at their displays and at the huge TV screen in the conference room were traders, not long-term investors. We were ushered into the fishbowl conference room and issued water. We dealt the cards.

Then I decided to shut down the huge, distracting TV screen.

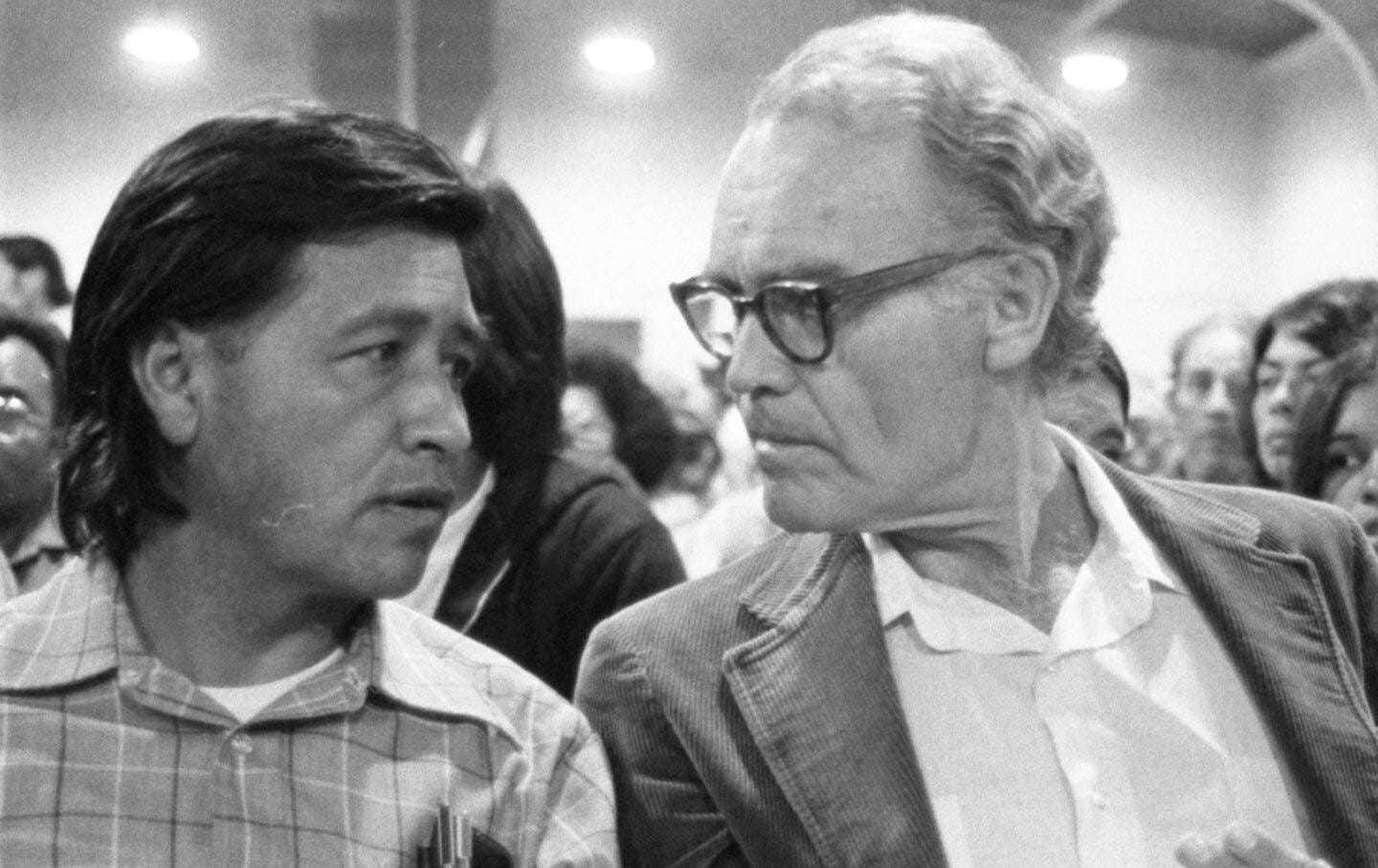

Credit for this move goes to Cesar Chavez, founder of the United Farmworkers and a brilliant and deservedly famous organizer. He learned community organizing from Fred Ross, who learned it from Saul Alinsky in Chicago.

The basis of Alinsky/Ross/Chavez style community organizing is the house call. It is a roadshow, except that instead of selling IPO stock to rich people, you sell community action to poor people. Both involve lots of meetings and the delivery of a brief, well-focused message, repeated until the audience either signs up or tells you to go away. Cesar understood that it was grueling work. He described the UFW as a pump that flushed idealistic young people through until they burned out and were replaced with a fresher crop. Flush until the water runs clear was a terrible way to build an organization and is a big reason that Farmworkers no longer have one.

I learned house calls from Cesar and Fred Ross, Jr. while organizing lettuce and grape boycotts in my UFW days. Neither would remotely approve of the use to which their training is now being put. House meetings had formal, demanding rules. One begins a house meeting by standing in front of the family television, which is always on. Once in front of the TV, everyone in the living room would be looking at you. At that point, turn around, shut off the TV, and promptly start the meeting. "Don't lower the volume" Cesar admonished us -- "SHUT IT OFF". He was emphatic on this: take the full attention of your audience, and start the meeting -- no PowerPoint necessary.

Well, it was time to start our house meeting, er, road show. So I grabbed a mouse and shut the foul TV screen off. The only way to do this was to shut the computer system down that powered the beast. The usefulness of the glass conference room improved immediately.

It was some minutes later that I noticed the traders gathering at the glass, giving me surly, incredulous stares as our meeting progressed. I had seen the expression in hundreds of less well-dressed folks suddenly uncomfortable with the silence of their own living room. The Bahama boys politely informed me that I had disconnected them from the outside world.

If only. My response, "...well, I didn't see any useful investment information coming through, so I figured I might as well shut it off" was not well-received. If these guys invest, it will be for a few days.

The experience drove home a distinction in the investors we meet with: some have Quotrons, some don't. A Quotron is a computer used by securities traders to report prices and execute trades. Perhaps some Quotron users buy and hold stocks long term, but they never give you that impression. When I asked whether some of these "investors" were hedge funds (private investment funds that bet against companies as well as for them), I was told, "we prefer to call ourselves capital management funds because companies doing IPOs are not comfortable talking to hedge funds."

In truth, we need a range of investors - some who hold long-term, others who trade the stock to create liquidity. But I prefer investors without Quotrons. On the other hand, if folks who don't like the company sell our stock and those who do like the company buy it, we will end up in good hands. Markets too, flush until the water runs clear.

Marty

Day Four: Momentum a Mile High

Wednesday, May 12, 2004. Denver, Colorado

Folks,

For the first time today, our bankers started to use a scary word -- momentum. It's one of those dangerous words that politicians, CEOs, and coaches use when we know that things are going well, but we don't know why. It is one of those nasty ideas that many people believe is self-reinforcing, but can also quickly become self-defeating -- especially if you believe in it. When I hear about momentum, I recall Benjamin Franklin's admonition to "never confuse motion with action". So far, our roadshow has produced motion. We would do well to not confuse it with action.

Our meetings are going well - some very well. The sales force of both investment banks is excited by the feedback from investors. Only one investor out of 25 has so far given us a firm "no" (for those of you who bet it was the guy who watches TV instead of reading, congratulations). But we got this far thanks to the hard work and smarts of a lot of people -- not because of momentum. We are not yet halfway done with the roadshow. We have more than 30 individual meetings to do and at least two major presentations before large groups of investors. I'd rather run scared than believe in momentum.

Nature reinforced the message yesterday. All month, Denver's weather had been building momentum toward a lovely summer. Then in three hours, a perfectly balmy spring day dropped 51 degrees, producing snow in the mountains and tornadoes in the flatlands. End of momentum.

We have plenty of reasons to run scared. The markets are down sharply; the Dow is below 10,000 for the first time this year. We are a small IPO sailing in large, choppy waters. Our small size is a big concern to investors and is the single largest reason that some won't meet with us. We have never made a dime of profits but have plans to grow spending - also a big concern. We operate in an unfamiliar and undocumented market that is currently being shaped by eBay and Amazon, with Google en route. Couldn't we start a business that is a little less behemoth-infested? These things scare investors - and they should scare us a bit too.

The balance of the roadshow is shaping up pretty clearly. Milwaukee tomorrow (Milwaukee? We are meeting four funds there but not stopping in Chicago. Go figure.) Boston on Friday, Pennsylvania and Delaware on Monday, and New York on Tuesday and Wednesday. After the market closes on Wednesday, all bids are due. The Board Pricing Committee meets, and we see if we have attracted enough interest to sell some stock. If we do, the stock will start trading on Thursday. If not, I will be home mumbling the pitch in my sleep and warning of the dangers of momentum.

Marty

Day Five: How High is Up?

Thursday, May 13, 2004. Milwaukee, Wisconsin

Team,

Milwaukee was a pleasant surprise. The airport has a very large used bookstore and I got a drive-by glance at the Santiago Calatrava-designed Quadracci Pavilion -- a museum perched delicately on Lake Michigan like a white bird poised for flight.

We started the day by kissing the ring of the godfather of Milwaukee technology investing. This local notable was a Self-Important Man who reportedly led many early-stage technology investment funds to locate here. It reminded me of raising money for political campaigns -- you want to take a shower afterward.

Self Important Man was rude and pompous - especially for a guy who, we learned this morning, is being investigated by Elliot Spitzer for his role in a mutual fund trading scandal. Self Important Man is "between offices", so we met in the hotel coffee shop, with the kitchen door continuously banging into our banker's backside.

Self-important Man wears a permanent scowl, asks questions he knows to be facile, and declares the need to leave early to appear busy. Guys on the verge of jail for stealing other people's money might find a touch of humility more effective - perhaps even justified.

Afterward, somebody said that it was like we had fallen into an opening skit for SNL. At any moment, you expected to hear "Live, from New York…"

During each meeting, we get a lot of questions. One we get a lot was best put to me as "How High is Up?", meaning "How big can this market be and therefore how big can Alibris be?" It is a frustrating question because it is important but not fully answerable. VCs tell me that eBay initially claimed that their potential market was $100 million. Today, those same PowerPoint slides indicate a potential market expressed not in millions, not in billions, but in trillions. The market did not change - but insights about it changed a lot.

In our case, figuring out how high is up poses problems that are not neatly resolvable with IPO sound bites.

You can't figure out how high up is by asking "How big is the used book market?" I get asked this a lot and I am often tempted to just make up a number. If you say "It is a $25 billion global opportunity" with confidence, they will take notes and move on. It's a dumb answer, however, and a fifth grader can see why: nobody wakes up and decides to buy a used book. You wake up wanting a book. You will buy a used one if you must because the book is out-of-print or if the used copy is cheaper but works just as well. Books represent one market because they capture one universe of demand - for books, not for used books.

The other problem with "how high is up?" is that secondary markets are upside down. They are frequently constrained more by supply than by demand. This is deeply counterintuitive but stop and think about it. How many new copies of The Da Vinci Code can Random House sell? It depends on consumer demand, which turns out to be very high. How many used copies of the same book can Alibris sell for $10 (Amazon sells the new hardcover for $15)? We can sell all of them - the issue is how many can we get? The point is that investors who wish to know how high up is need to focus less on the demand for books and more on how big the supply of well-priced used books can become.

If you want to understand the size of most consumer markets, you look at the volume of unit sales of similar items. Hot-selling cars, iPods, calculators, whatever -- hits drive the market and best-sellers are a huge focus because they generate enough volume to cover fixed marketing and production costs. But we are in the worst-seller business - and a lovely business it is. We rarely sell two of the same item because it turns out that online, everyone wants something a little different. Having millions of titles is unthinkable for a store - but it makes complete sense online. How much bigger does the market get when anybody can find anything? There are some mathematically valid estimates - but much of it is fancy guesswork. We are guessing - just like eBay was then --- and is now.

Marty

Day Six: You Must Be Salesmen

Friday, May 14, 2004. Boston, Massachusetts

Friends and Family,

Boston was packed. Six back-to-back meetings, including a nicely attended road show lunch, before we hit our final, seventh call. It has been a long week. Everyone was tired but feeling good as we cleared security and took the elevator up the innards of the John Hancock office tower for the second time that day. We were our usual foursome: our CFO, our banker, a sales guy from the investment bank, and me. Leaning against the elevator was an exhausted-looking guy who had had a long week as well. Hearing me give a pep talk about finishing strong for the week, he turned to us and announced "You must be salesmen".

Well, yes, but we prefer to think that it is not so obvious.

I confess to some ambivalence about the chief salesman's role. I am not concerned that I lack the requisite skills: one does not sell labor unions, Clinton administration policies, or McKinsey business solutions without learning something of the craft. Nor do I mind honest spin - Alibris is entitled to present the most favorable interpretation of our position, performance, and goals that honest facts will support. I can do these things. My concern is about doing them too well.

Salespeople are not generally rewarded for being honest, self-aware, or self-critical. It is not impossible, but the incentives work against it. When you spend your day repeating the sales mantra again and again and can quickly deliver answers that have been, in my case, literally practiced on camera for pithiness and punch, you risk the poisoning that comes from breathing your own exhaust.

Meeting investors in our market at the moment are at least two CEOs who are gifted media windbags. They are large, loud, forceful, charismatic men who brook no criticism of their businesses. They are both major league bullshit artists. Investors love them.

As you might imagine, this does not reassure the better angels of my soul. The problem is not that I am incapable of stuntsmanship or BS. Those familiar with my past would assure you that colorful, charismatic, and controversial are well within my range of experience and skills. It is a great deal of fun, especially if - as appears the case with these CEOs, your need for the attention of those around you hasn't evolved much since age four.

The challenge facing the Alibris board, management, and staff is that we have a real need to communicate to the outside world the power of our business model, the potential we offer investors and the performance we achieve. At the same time, however, we more than ever need to be candid about our weaknesses.

I am amazed that investors don't start our meeting by asking simply "Please tell me about the three biggest strategic and operational weaknesses of your business". Any CEO who cannot answer that question with specificity and without spin doesn't deserve a dime of capital. Answers that sound like a bad job interview ("My biggest weakness is that I work too hard and am too demanding on myself and those around me") should end the meeting on the spot. Convince me that you know how you are likely to get killed in the marketplace and I will believe that you understand the risks in your business.

How would I answer that question? Well, for better or worse, I have a point of view and I get up and go to bed thinking about it. I will happily share my thoughts with you, but first, you need to answer the question yourself. All of us will, in our way, need to become salespeople for Alibris - although ideally not all of us will undertake the sort of intense nonstop sales campaign that is an IPO roadshow. All of us must, at the same time, be aware of our weaknesses, and be free to talk about areas where our long-term strategy or near-term performance is less than we need it to be.

We should happily represent all that is strong and good about this company to investors, to customers, and our booksellers. I assure you that this will happily involve, in my case, the occasional stunt and fun. But none of us, especially me, should allow ourselves to be seduced by our bumper stickers or PowerPoint.

Our roadshow discussions occasionally penetrate the PowerPoint. Yesterday's moment came atop the John Hancock building, which was shrouded in morning fog. We could have been in San Francisco. It may have been foggy outside, but the guy we met was suffering none of it. At one point, when we were describing the low margins we achieve by listing seller inventory on Amazon or Barnes and Noble, he looked up and declared "Gross margins don't mean shit. Plenty of high-margin businesses go broke and plenty of low margin businesses get rich. Question is, are you making money or not?".

I thought our CFO was going to kiss the guy. I agreed, although I still have a hard time imagining my presentation to an investor conference featuring a PowerPoint slide titled "Gross Margins Don't Mean Shit".

Two closing notes.

I write from Faneuil Hall in Boston. It was here that talented people once debated serious issues about how to best live and work together and what kind of country to build. Today, these debates are at best media events, not passionate, face-to-face encounters. The public space is now commercial and Faneuil Hall is now a fine shopping mall. It is a monument to commerce driving out public debate - exactly what I do not want to see at Alibris.

Finally, Friday was Richard Weatherford's birthday. Dick's role at Alibris is less visible to our newer people than I wish it was. He is and always has been the keeper of the bookseller flame at Alibris and guardian of much of what is best and true about our company. My friendship and partnership with Dick has been one of the most satisfying professional experiences of my life. Happy Birthday from us all, Dick.

Marty

Day Seven: Whistle Stop

Monday, May 17, 2004. Philadelphia and Delaware

Alibrians,

Our "Mid Atlantic" day consisted of five high-quality meetings in Philadelphia and Delaware. The finish line is in sight. Bankers and sales guys are confident; I see no reason to be.

The day started with a nice surprise in the Wall Street Journal: our Self Important Man from Milwaukee made the front page for his mutual fund trading charges and our IPO got a nice write-up with no quotes from us for the SEC to get upset about. One of the two Loud 'N Proud CEOs is getting smacked by the SEC for quiet period violations. No Schadenfreude from me: it is not clear that the quiet period violations that he is accused of really matter even if he is guilty, which he may not be.

Going into our second meeting today, the sales guy warned us that we were facing a tough, charismatic customer who would not hesitate to bully and intimidate. It turns out that many investors did not graduate from charm school. This investor opens with a diatribe against our open auction process for pricing the IPO and he interrupts us a lot. But he was well prepared and asked good questions.

I noticed that he had an Armenian last name and watched my answers start to shift a bit. When he asked about who our booksellers were, I mentioned Steve Avadakian, a seller who was also my neighbor. When he asked about obscure author name keywords, I cited the example of AnnaLee Saxenian, my wife who published a book ten years ago. Another example involved William Saroyan. Of course, the investor knew that I was spinning him with Armenian examples. These were not in the prospectus, but they are all examples of information that is in the prospectus. By the end, he was asking me what Armenian dishes my wife likes to cook, whereupon I quickly changed the subject to her mother, whose Armenian cooking I had managed to enjoy in Boston over the weekend.

The meeting pointed out two features of the roadshow at this stage. First, it increasingly feels like an old-fashioned political campaign, crammed with more and more whistle-stops as Election Day approaches. Part of this is the grim work of trying to keep fresh a pitch that we have now repeated close to 50 times, just like politicians on the stump. But there is a more fundamental reason that it feels like a politician whistle-stopping during an election campaign -- we don't really know how we are doing until the votes are in. We have bits of polling data in the form of feedback from the investment banking sales force, but we don't know for sure how we are doing until it is over and our stock is trading.

The problem, and I did not see this coming, is that in the traditional approach to IPO pricing, bankers effectively bribe investors into bidding by offering them the stock at a price they are pretty sure is below where the stock will trade during the first day or two. That's why everyone loves to "get in on an IPO" - the assumption is that you will get the stock for cheap.

Are bankers providing kickbacks? In 2003, new issues shot up an average of 30% on their first day of trading -money that went to investors who took risks for a few hours instead of to the company that took much higher risks over many years. If our stock goes up 30% on Wednesday, I will be outraged, not delighted.

We think that we can avoid this by setting the price of our stock using an open auction process. All interested investors submit bids telling us how many shares they wish to buy and at what price. We will sell shares at the lowest share price that, together with all bids equal to or higher than this price, enable us to raise $25 million. It is a process that sets the price of our offering with more integrity because it is transparent. All investors pay the price set by the bid that "clears" the market - meaning raises enough money. If you were selling 100 copies of our Alibris cookbook using a Dutch Auction on eBay it would work the same way - everyone would bid whatever they wanted, but the 100 highest bids would get cookbooks at the lowest price that would clear the shelf of 100 copies of the book.

I like auction-based IPOs and would mandate this approach in all public financings. Now that Google has announced that they want to use an auction to price their IPO, auction-based pricing has been validated by the largest, most prominent IPO the world has ever seen. Although our IPO is not "Powered by Google", both CNN and the Wall Street Journal have indicated that they would like to cover our IPO to understand how auctions work as a part of their reporting on Google. The SEC's quiet period rules prevent us from cooperating with these inquiries.

Dutch auctions may be less prone to abuse than conventional IPOs, but they do create real problems - especially for small IPOs like ours. When you set the price of a stock using an auction, investors have no reason to submit their bids until the last minute. An early bid just gives bankers the ability to talk up the price and urge subsequent bidders to bid higher. That is why I am running scared - we are not "building a book" like conventional bankers do so much as we are waiting for bids to develop at the last minute.

This reveals a fundamental problem: the first-day investor takes a big risk that an investor on the second day of trading doesn't. Initial investors help set the price of what will likely be a fairly illiquid stock. Investors are entitled to be paid for taking that risk - otherwise, why not buy on the second day, instead of the first? An auction process might compensate them for that risk -- or it might not.

Auctions are a fine way to price a liquid stock, but I wonder if it will work for an IPO that is small and at the edge of what the market will agree to finance. Will investors conclude that an auction will not pay them for the risk, that the financing is mis-priced and trades down? If so, they will not bid and the IPO will fail. An auction with a lot of bids should ensure that this does not happen, but what about an auction with a small number of bids? It would be like auctioning our 100 cookbooks with only two bidders in the room - you would not be confident in the pricing signals you got. In this case, you might prefer a process that gives investors an incentive to jump in and get the trading started. Google doesn't need this. Alibris could turn out to be another matter.

For these reasons, auction-based IPOs are more suspense-filled than those that allocate shares to "friends and family". Using the traditional process, investment bankers force investors to commit early. Everyone understands that the investors are getting a kickback in the form of guaranteed first-day trading gains. Because bankers are cutting their pals in on lucrative deals, they can force them to commit in advance (and they can and do extract other favors as well). Although the risk of corruption is higher, the traditional approach to pricing does give a company a much better picture of how much money you are raising as the road show unfolds.

We are not offering kickbacks, so we keep our message sharp and take each meeting like it was the last investor we were ever going to pitch. We kiss every baby and smile for every camera. And at times, it gets a little obvious. We will not know until Wednesday evening whether or not we have a successful deal. Only one account in four has at this stage told us no. That seems OK -- but it's all the feedback we have. We will know a little more until election eve - Wednesday night.

So we continue to kiss investors, shake their hands, focus our message, and keep moving. Election returns come in after the polls - I mean the markets - close on Wednesday night in New York. By Thursday, we will either have a publicly traded stock or we will be planning the comeback campaign.

Marty

Days Eight and Nine: Early Returns

Wednesday, May 19, 2004. New York City

Friends,

Your correspondent went silent yesterday. Tuesday was a brutal 17-hour day - it turns out that raising money in New York is a contact sport. Seven private meetings with teams of smart, articulate, skeptical investors, a lunch speech, two updates with the capital markets banking team, a board meeting, and a late-night huddle with lawyers. When it ended at 10 pm, I had a light dinner, then took a walk after midnight in the leafy neighborhoods of the Upper East Side, figuring that in this neighborhood I was unlikely to be mugged a second time in one day.

We had already pitched four different funds before our noon presentation to a group of investors at the 21 Club - a public restaurant preserved from the days when business was done over port and cigars at dark-paneled gentlemen's clubs. The lunch, which featured neither port nor cigars, was well-attended, with fewer questions than usual. Bad sign.

This was the next to last day of the roadshow, so the update calls with the capital markets team took on a new urgency. We continually seek detailed feedback from the sales team - the folks charged with following up with the dozens of accounts we had pitched to turn interest into investment.

I hated these calls because they mixed lavish praise for us with pitiful results. By mid-day, it was clear that the bids for the stock were below the range. As the day wore on, it was clear that we were not generating investor bids that were remotely consistent with the treacherous "momentum" that the sales desk kept assuring us we had built.

Damn. Confer with the board pricing committee; confer again with the sales group; conference call with the full board. Agree to reprice our offering by reducing our price slightly because the sales group believes we have "infinite" interest at a slightly lower price point. But this small reduction has the effect of reclassifying our offering: we would be a small-cap market stock - a corner of the NASDAQ with some peculiar legal challenges. Not awful, but not ideal. In the middle of this, the SEC complains about the button on our website linking to our investment bank; they talk of penalties and cooling-off periods. Their quiet period enforcement has gone mad.

This is too much variation for a complex process like an IPO; I should not be calling audibles in the final minutes of this game. I am concerned about the focus and commitment of the sales group and demand that the bankers apply the lash hard. These guys are my pollsters and after six months of incredible work and two weeks of nonstop campaigning, I no longer believe a word they say. It is election eve, returns are starting to come in -- and I don't like what I see.

The final day of the roadshow began this morning. More capital market updates and three more investor meetings. Investors smell blood - announcing that you have decided to lower your price slightly is like opening the presentation with "Well, nobody likes this deal at our current price - would you care to bid lower?" Worse yet, the lawyers are scrambling - it is not at all clear how we will deal with some of the legal requirements for selling in the small-cap market. Worse, the sales force is producing bids in the new range, but not fast enough and not convincingly enough. Some large accounts who have committed are holding back to see if the price falls.

I breathe deeply and am furious - our bankers have misread this market and our lawyers did not prepare us to trade on the small-cap exchange. I share my pain generously. There is hell to pay; I vow that those destined to pay it will not relish the experience.

Our CFO and I returned home a day early. In the car to the airport, we got another update from the capital markets sales team. Then another legal powwow - our lawyers have more ideas than answers. We update the management group by phone - our lawyers and bankers have set up financing that cannot be legally closed. At JFK, CNN reports that the Blue Nile IPO has priced and is oversubscribed; the new issue of The Economist blares "E-Commerce Takes Off". I find Peets and look for a dog to kick.

Some perspective. The auction process for IPOs, like the all auction processes, is a process of price discovery not happiness discovery. The process guarantees that you will discover the current market price of your company or whatever else you auction. It does not guarantee that you will be happy about that price. In a very choppy public market, investors may be financing large, profitable companies, but they are telling us that there is a penalty for being small and not profitable. Why this turns out to be a surprise to our bankers or attorneys, however, is beyond me. They have a great deal to answer for - I would not want to be in their shoes in their next appearance before our board.

So where do we stand? We cannot close this offering. It is remotely possible that during the next 48 hours, we will decide to raise money on the small-cap exchange, but the obstacles to doing this now are substantial. We may undertake private financing.

This ends my dispatches from the road. Thanks especially to Brian Elliott and others who served as my wingmen by minding the store back home and to the many of you who did an outstanding job helping us to prepare. Thanks to those who appreciated these notes -- and to those who didn't appreciate them but were nice enough to not tell me. The notes were fun to write, even if you cannot circulate them. It's a good story -- even if the ending needs work.

Marty

Postscript: The New York Times Shills for "Open IPOs"

March 18, 2006

Joe Nocera at The New York Times offers up a puff piece on W.R. Hambrecht and Company and its Open IPO process on the front page of the Business Section today.

Tip: any article that leads with “William R. Hambrecht took a seat next to me at a conference table in the hip San Francisco offices of his eight-year-old investment bank, W. R. Hambrecht & Company” is not going to be hard-hitting.

The article details the advantages of allocating the shares of an initial public offering using an auction, the Open IPO process pioneered by Hambrecht (at enormous personal expense) during the past several years. Key section:

"The purpose of an initial public offering has never been to enrich big, powerful investors with a guaranteed one-day profit. Contrary to popular belief, those 200 and 300 percent first-day price jumps, which so enthralled investors during the dot-com bubble — that wasn’t good. That was terrible.

"The purpose of an offering is to raise as much capital as possible for the company, capital it can use to hire employees and roll out products. When an issue is underpriced, it means the underwriter has hurt the company that has hired it. And when an issue is purposely underpriced, it means that the underwriter is taking care of Wall Street instead of its client. Mr. Hambrecht, 70, is out to change that.

The article cites Traffic.com and Morningstar as recent examples of successful Open IPOs but cites no examples of open IPOs that failed. This is an interesting omission. Bill Hambrecht pioneered the business of getting small, growth companies access to public equity markets. It’s a high-risk, high-reward strategy.

It is high risk because an IPO in a small company is incredibly disruptive. The cost of legal preparation and the distraction to a senior management team that is already stretched thin can mean that a small company that undertakes an IPO places its life in the hands of its investment bankers.

It is also risky because small company IPOs often don’t work. The stock of a small company frequently does not trade enough to ensure liquidity – meaning that every buyer cannot always find a seller and vice versa. This discourages large institutions from buying a stock in the first place and means that one or two large trades can drive a small company’s price up or down irrationally. Even if a company goes public some, like Salon, Briazz, or Red Envelope (all Hambrecht Open IPOs), quickly trade down, their prices collapse, and never achieve real liquidity.

A company that hires an investment banker buys three services. First, they buy the knowledge of capital markets, meaning what kinds of companies that public investors will finance at what prices. Second, a company buys a navigator to get them through the arcane world of SEC regulations and filings, meetings with analysts, and pitches to prospective investors. Third, a company gets access to high-quality investors. It is possible to get all of these services other ways, but bankers charge nothing until a deal closes, so their incentives are generally aligned with the company’s.

The quality of these services comes out the moment a company’s shares start trading. If the price goes up a bit, say less than 20%, a CEO and his or her investors are happy. Failure, you might think, would be for the price to go down. This is a failure, but in the near term it is the bankers, not the company who get hurt when this happens because the bankers priced the offering and the institutions who bought from them will be mightily upset. The company has sold its shares for cash and is not directly affected by trades that occur between shareholders.

Real failure turns out to be when the stock price shoots up on its first day of trading. This form of mispriced offering means that the value created by investors, managers, and employees over many years was captured by day traders, not by the company. An IPO that goes up 50% or more the first day was, almost by definition, mis-priced. During some years of the dot-com bubble, the average IPO went up by more than 50% on its first day of trading, so a small company CEO who undertakes an IPO thinks very hard about which underwriter to use. Those who hire Hambrecht do so believing that the Open IPO process works.

I took that bet and lost – and it very nearly cost me a company that I had spent five years building. Although Hambrecht failed, the fault was not with the Open IPO process – it was with the execution of the underwriting.

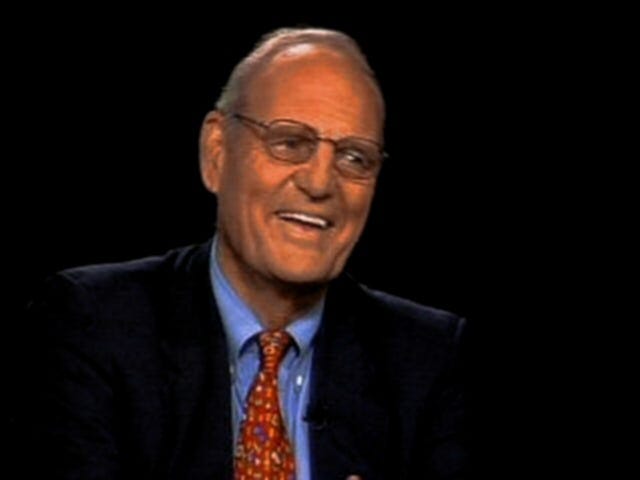

In the closing days of 2003, I invited Bill Hambrecht to meet with the board of directors of Alibris, an online book company that I had started in 1998. Hambrecht is a revered figure in Silicon Valley and he is an excellent salesman in the best sense of the word. He has made a large pile of money but gives the impression of not caring much about money. What he seems to enjoy is helping small, growth companies raise the capital they need to succeed.

Several investment banks and one prominent investor warned me that an IPO was a foolish way to finance a small company like ours, regardless of whether it was done as a conventional or open IPO. But we needed to finance and private capital was hard to come by. In early 2004, public markets were finally opening up after the dot-com crash. Hambrecht assured us that we could finance at attractive rates, so at my recommendation, our board signed up for an Open IPO.

In retrospect, Hambrecht promoted an underwriting that was grossly ill-advised. The capital markets were funding companies that were large, fast-growing, and not profitable (Overstock.com, another Open IPO) or small, fast-growing, and profitable (Blue Nile, which went public with a conventional IPO the same week we tried to). Companies that were small, fast-growing, and not profitable couldn’t finance or, if they tried, struggle with illiquidity (Red Envelope). There were no exceptions to this — and therefore no basis for Hambrecht to believe that we could access public capital (the small public company that they pointed to that loses money, Drugstore.com, would not have been able to conduct an IPO when we tried to).

Our roadshow confirmed this. According to Hambrecht, approximately 80% of the accounts we visited reported that our market cap was too small (under $100 million) and our lack of profitability was too large a barrier for them to invest. Of these two concerns, our small market cap was raised about twice as often as profitability, although many accounts mentioned both. Since Hambrecht knew our profitability and likely market cap in advance, the assurances he gave us in December that the company was publicly financeable turned out to be, at best, questionable.

Companies count on bankers to judge correctly investor demand for their stock. Hambrecht could not. On the Tuesday before the road show began, the Hambrecht Commitment Committee reviewed our pricing and approved our filing range (they did this without the benefit of an auction – they knew, or thought they knew, where the stock would trade).

Throughout the first ten days of the roadshow, Hambrecht voiced no concerns about the strength of the book or our price. Not until we arrived in New York on Monday evening, 48 hours before our scheduled close, did we first hear pricing concerns. At that time, they advised the board to reduce our price because there was plenty of demand for our stock at lower prices. Well, an auction finds a market clearing price, not the price that makes the CEO happy. Disappointing, but fair enough – so we lowered our price.

Unfortunately, this lower price left our company below the minimum size required to sell shares on the NASDAQ. After more than six months of intense work with attorneys, accountants, and investment bankers preparing the IPO, after an intense 12-day road show to sell the offering to investors, our offering failed.

The problem was not a lack of interest by investors; we had plenty of that. It was not the Open IPO process, which did what it was supposed to do and produced a market price for our stock. Our IPO failed for a technical reason that Hambrecht should have foreseen: the price that investors set for our stock left us below the market cap threshold required by the NASDAQ National Market Exchange, which requires that a company must have a market capitalization of at least $75 million (companies can qualify by meeting other tests based on assets or income, but we needed to qualify based on our market cap). If the Alibris market cap dropped below $75 million, our bankers knew that we would not qualify to trade on the NASDAQ National Market. We were too small and Hambrecht had failed to anticipate. We pulled the offering.

To be balanced about it, much of Hambrecht’s work was excellent. Their legal counsel was outstanding in preparing the SEC filings. They gave us very useful feedback on the roadshow. They presented us with solid investors. When they did fail, however, it was spectacular and costly.

During the post-mortem of the IPO, when there were recriminations enough for everyone, we challenged Hambrecht and his senior team as to whether this entire effort had been a mistake. They twice acknowledged that "we have never seen this happen. We like this company, but may have been seduced by your story and your management team, which we liked better and better as time went on".

Obviously the board, and especially me, share responsibility for our decision to file for an IPO, but I have a hard time concluding that we made this decision with the benefit of sound professional advice.

Was the failure related to their Open IPO process? Only to this extent: Hambrecht tends to overlook the risk that first-day investors take when they agree to buy a new stock. A traditional banker gets the trading going by allocating shares to friends, family, and favored institutions at a price virtually guaranteed to create a “pop” – a first-day trading gain. With some justification, Hambrecht regards this as a fundamentally corrupt way to price a stock.

Hambrecht targets small companies whose stocks will be, at best, very thinly traded. Rather than take the risk that a stock will turn out to be illiquid, an investor can simply wait and decide to buy the stock later. A rational investor would never take any financial risk without a financial reward – which means that they had better get a pop on the first day of trading or they would be better off buying on the second day. If auction pricing minimizes or misprices the first-day trading premium, the obvious risk is that, over time, investors will not bid. I will, of course, never know to what extent this contributed to the price we were offered for our securities.

People have often asked me if or when I take a company public again, will I use an auction to set the opening day price? My answer is hardly an homage to efficient markets. Taking a company public is like getting a heart transplant: you only do it once and you need it to be done very, very well. It is not a decision driven by price. You look, as Hambrecht himself acknowledges, at the results themselves. I would pick an underwriter who had a sterling record of getting IPOs done and did not give too much value away in first-day trading gains.

Would I invite Hambrecht to present to my board? Absolutely yes – Bill is a gutsy guy whose ideas make sense. He does not have a silver bullet however and his approach is not the right answer to every company’s problems.