Democrats have scratched their heads raw trying to figure out how Donald Trump could win two out of three presidential elections despite his felonious personal conduct, glaring incompetence, and support for widely unpopular policies. We often overlook a critical explanation for Trump’s Teflon: his first-term economic policies were moderately competent.

Under Steve Mnuchin and Gary Cohn, Trump the First pursued a conventional conservative economic strategy: cut taxes, particularly on capital investment, and borrow money in response to the Covid pandemic. Democrats had legitimate disagreement with these policies: the 2017 tax cut worsened fiscal inequality and unnecessarily inflated the federal debt—but these actions supported robust growth and tighter labor markets. Voters rewarded Trump for a decent economy.

Trump One wisely sidestepped politically toxic cuts to Medicare and Social Security (he won the GOP nomination by criticizing Mitt Romney for advocating them). When Congress killed his unpopular plan to repeal Obamacare, he paid almost no political price. Trump One kept his tariffs narrow and targeted.

Today, Trump Two announced broad tariffs on all imports. Broad tariffs are genuinely dumb. They raise consumer costs, reduce economic efficiency, and disrupt global supply chains. They also raise costs for US companies that import materials and intermediate products. Prices increase across the board, and living standards decrease as companies invest in less productive domestic industries. The price of tee-shirts will go up, even though nobody is moving a tee-shirt factory to the United States.

Economists who believe that the US should retain advanced and critical defense manufacturing prefer policies like targeted subsidies, research investments, and workforce training over tariffs on all imports. Broad tariffs protect inefficient companies and provoke retaliatory tariffs on our exports, penalizing companies who sell overseas. Exporters are our most competitive companies and thus get slammed twice: we have provoked their customers into raising tariffs, and our tariffs have strengthened the dollar, making all exports more expensive. Targeted industrial policies, on the other hand, allow for selective support to sectors crucial for national security or technological leadership without broadly undermining consumer welfare and overall economic efficiency.

Republicans and Democrats have overlooked the big differences between Trump One and Trump Two. They have mistakenly read Trump’s low but stable approval numbers from his first term as proof that he has an unshakeable hold on nearly half the electorate.

There is another way to look at it, however. 2017–2019 were economically stable. Trump’s response to Covid, hardly flawless, delivered vaccines and was broadly considered adequate. After Trump left office, Biden made more tangible economic mistakes. In this view, voters returned Trump as a gamble for stability and economic growth.

But 2025 is radically different than 2017. Trump’s initial tariffs had minimal impact, partly because he balanced them with pro-growth measures and targeted subsidies. In contrast, the tariffs he’s now imposing carry a much higher risk of inflation, supply chain disruption, and job losses. Voters and businesses know this; Trump’s approval rating on his handling of the economy is already underwater by nearly 20 points – and his tariffs have not yet taken effect.

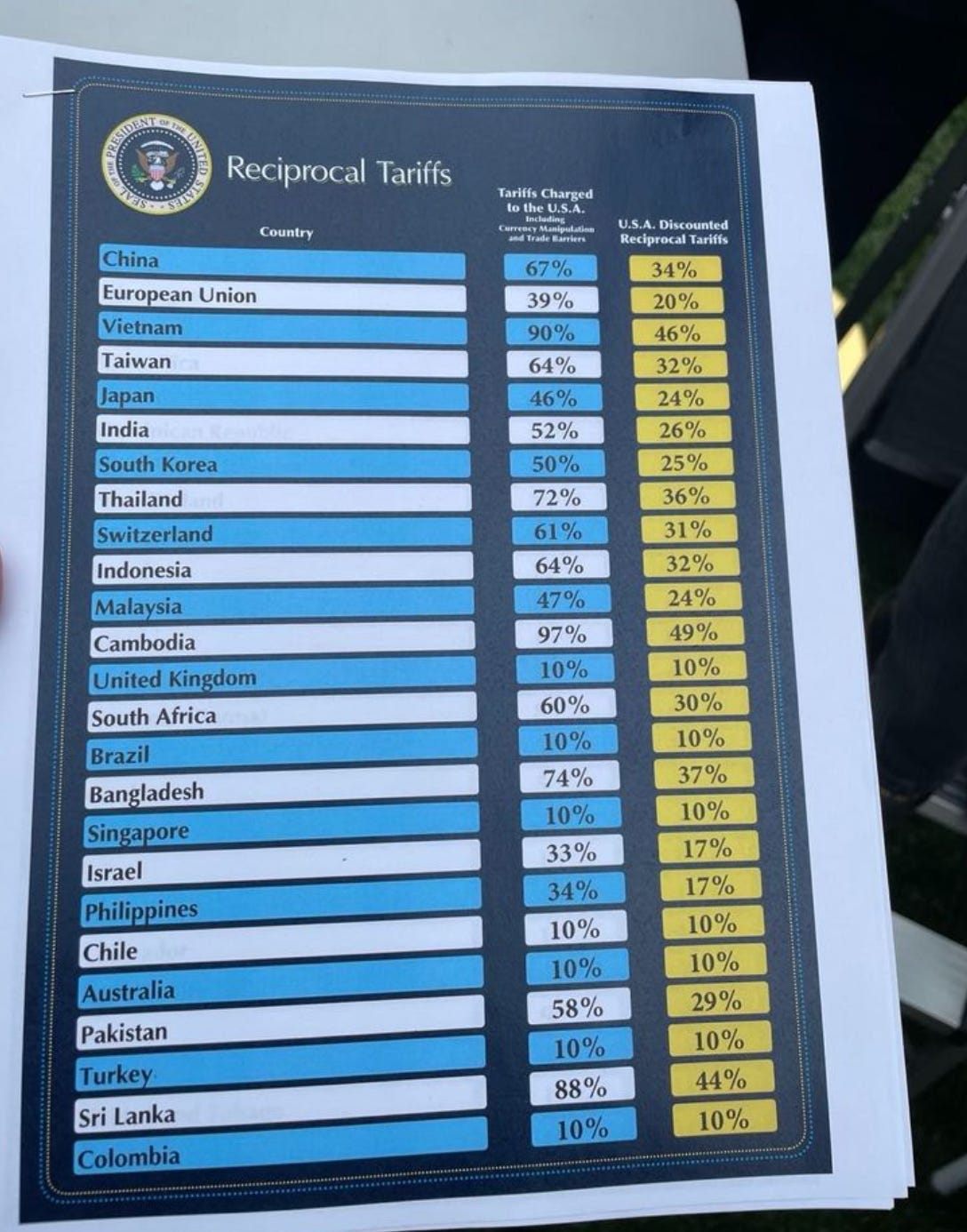

Of course, Trump’s tariffs are not simply the product of defective policy planning. They also reflect deeply held personal beliefs devoid of policy reasoning and not subject to moderation by competent people around him. Trump’s “Reciprocal Tariffs” table announced today strongly reinforces the sense that no adults are in the room.

Paul Krugman earned a Nobel Prize for his work on trade. He took one look at the reciprocal tariffs shown above and commented:

“The left column shows the tariffs others are supposedly charging on US products — and it’s completely crazy. Focus on the European Union. The EU, like the United States, has generally low tariffs; the average tariff it charges on US goods is less than 3 percent.

“So where does this 39 percent number come from? I have no idea. Many people speculated that Trump would count value-added taxes as tariffs, even though they aren’t — European producers selling to the EU market pay the same VAT as US producers, so it doesn’t discriminate and, therefore isn’t protectionist. But even if you get that wrong, EU VAT rates are in the vicinity of 20 percent, so you still can’t get anywhere close to 39 percent.

“You have to wonder whether Elon Musk’s Dunning-Kruger kids are now producing tariff numbers.

“But you know that having once claimed that Europe charges tariffs more than 10 times as high as reality, Trump will never drop that claim. I don’t know how many people noticed, but he’s still claiming that we’re subsidizing Canada by $200 billion a year. Aside from the basic mistake of claiming that a Canadian trade surplus means that we’re somehow subsidizing Canada, he’s inflating the actual trade surplus by a factor of three. Many, many people have pointed out the error, but Trump is sticking with it, the same way Musk is sticking with the millions of dead Social Security beneficiaries thing.”

Voters did not elect Trump to return America to the economic policies of the 1890s—an era of protectionism epitomized by the unpopular McKinley tariff that Trump seems to love. Voters chose him to restore pre-pandemic normalcy, stability, and manageable living costs.

Republicans paid dearly when McKinsley’s tariffs drove up prices and were devastated in the 1890 midterms. Many Republicans know this. If Trump insists on a repeat performance, Republicans will pay a heavy price for policies voters neither asked for nor want.

CODA

Iyad ag Ghali was a rock musician I once followed. His band, Tinariwen, played with Led Zeppelin’s Robert Plant and U2’s Bono. Now, he’s the leader of the most feared al-Qaeda group in West Africa and responsible for thousands of deaths. Read his story at the link or enjoy his excellent music (which he has, of course, banned).

If I am right, tariffs mean more things made in America and lower taxes. If I am correct, then I am going all in. https://tinyurl.com/yeyp6evt

I think this is where those seemingly made up numbers come from:

Japan for example doesn't have 46% tariffs against the US. The 46% he claims was derived from the trade deficit with each nation--NOT tariffs.

We exported 68 billion. We imported 148 bill. 148 - 68 = 80. 80 / 148 = 46% "tariffs" Trump claims Japan imposes

https://rogueandrebel.substack.com/p/trumps-reciprocal-tariffs-are-a-lie?utm_source=share&utm_medium=android&r=4dclbd