Elon Musk’s Department of Government Efficiency is neither a department nor concerned with efficiency. It is a lurid anti-government crusade conducting a culture war against left-coded universities, scientific research, and human services. Musk is shaping a federal government that will be easier for his fellow oligarchs to control and corrupt.

This is not just a travesty but a missed opportunity for Musk and the US. The federal government needs to make a determined effort to merge redundant programs and eliminate ineffective ones. It must upgrade ruinously fragmented systems and recruit first-rate technical and leadership talent. We need more experimentation and learning, which is challenging in government because politics makes people risk-averse. Musk is doing none of these things. He is administering a bracing dose of his trademark chainsaw work — Congress and the law be damned.

It is starting to dawn on Donald Trump that DOGE is politically costly. No other White House would allow the president’s largest donor to lead a headline-grabbing, budget-slashing crusade. Trump tried to rein in Musk by declaring DOGE “advisory” to the cabinet secretaries and chiding him into wearing a suit. Even if Trump’s real goal is to distract attention from his proposed tax cuts for the rich and service cuts for the poor, Musk’s time in Washington will end badly.

Elon is failing – and taking Tesla with him.

One obvious sign: everyone in Washington hates Musk. Democrats and independents have long despised him as Trump’s financier and designated hitter. Cabinet members hate him slashing their agencies without logic or consultation. JD Vance loathes Musk because he wields more political, cultural, and economic power than he does. Congressional Republicans resent a multi-billionaire who threatens to fund their opponents if they stray from MAGA orthodoxy. GOP officials hate that Musk’s vandalism inspires so much local hostility that they had to ban Republican representatives from holding town hall meetings.

Musk was not always a culture warrior. Musk 1.0 earned his spot on the short list of history’s finest entrepreneurs by building important companies in demanding industries. These companies are valuable: Tesla (market cap $700b+), SpaceX/StarLink ($150b), xAI ($50b), X ($44b), and Boring/Neuralink ($5b each?). Each of these companies has benefitted from a psycho/visionary willing to ignore institutional obstacles and bulldoze opposing personalities. It can be ugly to watch, but the results are often impressive.

Elon 1.0 was a normie, libertarian Democrat. He donated to everyone but backed Democrats for president. He supported Obama over McCain and Romney and Clinton and Biden over Trump. Back then, he tweeted about a dozen times a week. In 2018, one of his tweets claimed to have secured funding to take Tesla private “at $420/share”. The price was a weed joke, but the SEC did not laugh. Musk was forced to pay a $40 million fine, step down as Tesla chairman for at least three years, and restrict his social media activity.

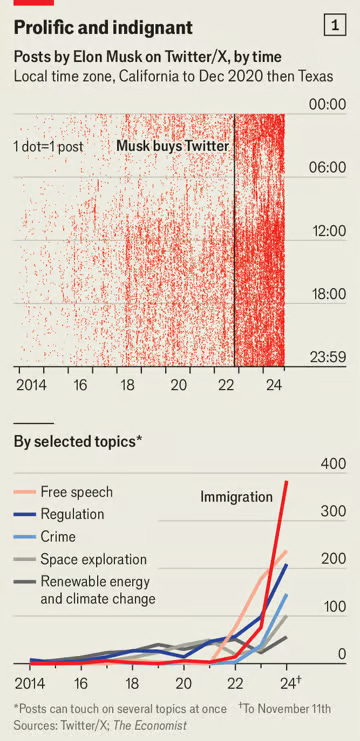

The SEC (and perhaps his growing need for ketamine) spawned Elon 2.0. Between then and October 27, 2022, when he closed on his purchase of Twitter, he tweeted ~50 times a week. He began sharing his frustration with Covid rules, speech restrictions, factory lockdowns, etc.

Since he bought Twitter and renamed it X in 2022, Elon 3.0 has become obsessed with immigration, free speech, regulation, and crime. The Economist determined that he has posted around 220 times each week to his 220 million followers since this time. He frequently promotes conspiracy theories and voices support for MAGA. He has backed Germany’s AfD and far-right political parties in at least eighteen countries worldwide. This has made him incredibly unpopular with current or prospective Tesla owners. Consider:

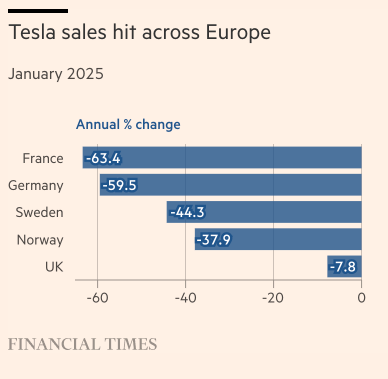

European sales fell by half last year. Australian sales are down 70 percent.

North American prices on both new and used Teslas have dropped. Dealers report even their discounted models take longer to sell.

Deeply competent Chinese competitors are circling. Tesla production in China is off by half. Trump’s moronic tariffs will make this problem worse, not better.

Tesla cars, dealerships, and charging stations have attracted protestors, vandals, and arsonists. Trump’s threats to prosecute protests as “domestic terrorism” and put demonstrators “through hell” would damage Tesla as much as the constitutional order.

Tesla share prices are down fifty percent from their post-election high. This week, they suffered their steepest decline ever. Trump tried to rally the market by buying a Tesla after ridiculing EVs during his campaign. Many Tesla owners have affixed apology stickers that denounce Musk. Other owners have rebranded their vehicles, often hilariously.

As one analyst acknowledged, “Everyone knows that Tesla has a bit of a CEO problem.” The Tesla board of directors knows that its CEO is damaging the company. A normal board would replace a preoccupied leader who drove away millions of customers. Normal boards replace CEOs every day for far less.

Musk is damaging Tesla, which is poised to become one of the most valuable companies ever created. The stock is still expensive – it trades today at 110 times earnings, compared with 7-8 times earnings for most US car companies. Investors have bet for years that the company would dominate self-driving robotaxis.1

After years of delays, self-driving cars are now starting to scale up. Tesla is running well behind Google’s Waymo in deploying robotaxis, but it is better positioned for long-term success.

Musk can lead his companies or remain a culture warrior for the Trump administration. He cannot do both and is vastly better at the former. He should fire himself, pass DOGE to others, and focus on making Tesla, SpaceX/Starlink, and xAI into world-beating companies. His companies need his leadership:

SpaceX is now the world’s leader in placing payloads into low-earth orbit. Their Falcon Heavy rocket can put almost 64,000 kg into LEO for $90 million, or about $1,500 per kg. China and Russian rockets cost three times more to deliver the same weight. Europe’s Ariane5 costs six times more.

Starlink is part of SpaceX and accounts for most of SpaceX's revenue by providing remote internet access via satellite. Starlink has 7,000 satellites in orbit today and plans to increase that to 42,000. Airlines are rolling out Starlink (it was free and blazing fast on two trans-Pacific flights I took this week.) Starlink is developing a "Direct to Cell" service that allows satellite connectivity for existing LTE phones. This enables texting, calling, and browsing in areas with poor terrestrial coverage. They have announced partnerships with T-Mobile, Rogers (Canada), Optus (Australia), KDDI (Japan), and Airtel (India) to provide satellite connectivity. This is a massive market.

xAI, founded in July 2023, is an AI platform devoted to transparency and interpretability. Its goal is to make AI systems and their decisions understandable to humans. Within 16 months, xAI achieved a $50 billion valuation – a milestone that took OpenAI nine years to achieve.

Musk controls Twitter/X, his personal media platform. He also owns the Boring Company and Neuralink. Although X has recovered in recent weeks, these seem like less valuable businesses.

However, Musk’s real opportunity is Tesla, which is poised to win the race for self-driving cars.

Elon should leave DOGE and help Tesla win the race for self-driving cars.

Two months ago, as my wife and I drove east along Cesar Chavez St. in San Francisco, I noticed a self-driving Waymo robotaxi in front of me and another behind me. I saw several Waymo robotaxis approaching westbound and began counting them like a bored child on a long drive. In the next mile, I counted seventeen white Jaguars with spinning blue lidars. They are everywhere in San Francisco, which has never been the easiest city to drive.

As Tomas Pueyo recently detailed, the Robotaxi business is a challenging mix of technology, economics, and regulation.

Technology. Self-driving cars capture and instantly map sensor data. Waymo relies on lidar, radar that uses light instead of radio waves. Each Waymo has four lidar units, 13 cameras, and six conventional radars. Tesla abandoned lidar in 2022; each car now features eight cameras, 12 ultrasonic sensors, and a forward-facing radar. A Tesla generates up to 25 GB of data per hour by continuously updating a map of the surrounding terrain. It is the steady accumulation of data and improvements to AI algorithms that process it that improve self-driving cars.

A year ago, people still wondered whether robotaxis were safe. In reality, a Waymo is so secure that it’s boring. In December, Swiss Re released an analysis of collisions during Waymo’s first 25.3 million self-driving miles. This driving occurred in Phoenix, San Francisco, Los Angeles, and Austin. The study compared Waymo’s liability claims to human drivers. It found that the robotaxis caused 88% fewer property damage claims and 92% fewer injury claims than human drivers. In tests, a Waymo reacts 150X faster than human drivers, partly because they never get tired, distracted, angry, or drunk. After several years of learning, a Waymo now drives better than you or me.

Tesla's full self-driving (FSD) is also improving rapidly. Tesla records every time FSD disengages and reverts control to the driver. As it gets smarter, FSD disengagement becomes less frequent. Analysts and skeptical users have pieced together how FSD disengagement rates are changing. They report massive improvements. Most analysts conclude that FSD is safer than human drivers in most situations. Tesla expects to launch an unsupervised robotaxi network in Austin, Texas, this summer and in California later this year. Tesla can deploy new cars, vehicles coming off lease, or a dedicated Cybercab. Tesla will test the Cybercab in Austin this summer. If validated, they expect to begin full-scale production of Cybercabs by the end of 2026.

Economics. The economics of self-driving vehicles are changing rapidly. The Bureau of Transportation Statistics estimates that owning, operating, and maintaining a car costs $0.81 per mile. Ark Research estimates that Uber and other “Human Ride-Hail Services” cost $2.00 per mile compared with Robotaxis at $.25 per mile – one-eighth the cost. At even one dollar per mile, however, they estimate the market for automated ride-hailing to be one trillion dollars. They believe the market will grow to $2.4 trillion if costs fall to $.60 per mile.2

What does this all mean? It means that cabs, which are vanishing quickly, will disappear altogether in the next three years. Uber and soon robotaxis will put them out of business. It means that car ownership is very likely to decline after that. The decline will start in cities and nearby suburbs, where parking is expensive and miles driven are lower. Finally, it means that Google will likely buy Uber and phase in Waymo.

As robotaxi fares drop, they will serve as a new form of public transit. Riders prefer to travel when they want, not according to bus or subway timetables. They will favor point-to-point travel over station-to-station. They will be happy not to share space with others, which reduces the risk of crime and contagion. Parents in San Francisco are already sending their kids to school and sports practice in Waymos. As mass transit loses riders, public transit systems will be unable to support their high fixed costs. Oakland, Philadelphia, and Tampa already find it cheaper to subsidize Uber rides than to pay for mass transit.

Regulation. Will regulators stop robotaxis? Almost certainly, in some cities. Oregon still blocks Uber outside of Portland. Several cities protect failing taxis by banning Uber airport pickups. However, most cities will look at the positive experiences of Phoenix, San Francisco, Los Angeles, and Austin. Will state and municipal regulators bar Tesla from deploying robotaxis? They might, which is why Musk would be wise to fire himself from DOGE and refocus his talents where he can improve lives, not degrade them.

Tesla and Waymo are the last two self-driving car services outside China. If Tesla can stop hemorrhaging public support, it will likely win.

Tesla has a cost advantage. It makes its own cars and can lower costs as manufacturing efficiency improves. Also, roughly half of Teslas are leased, and every vehicle coming off lease can become a robotaxi. Tesla can scale its robotaxi business very quickly. (Otherwise, its stock will trade at perhaps 10-15 times earnings, not 110, and Musk’s shares will be worth ~$10 billion, not ~$100 billion).

They accumulate more data because they have more cars on the road. Their vehicles should be able to get smarter faster.

Tesla will soon test specialized Cybercabs (pictured below) in Austin. Cybercabs are vastly less expensive to build than Waymo cars.

Tesla can charge less than Waymo and still be nicely profitable.

Tesla will have few competitors. It has outlasted several rivals, including car companies like Volvo, GM, Audi, Nissan, Mercedes, BMW, Daimler, and Continental. Tesla has also seen Apple, Uber, and Starsky abandon their efforts to build self-driving cars.

If Tesla can execute a global rollout of autonomous vehicles, it will become a very valuable company.3 With SpaceX (which currently surpasses Musk’s Tesla holdings) and xAI, Musk could become the world’s first trillionaire. I could pick better people for this honor, but leading these companies is a better use of his talent than DOGE, an effort starting to reek enough that even JD Vance has begun to steer away from it.

America would be better served if Musk returned to what he excels at. Can Elon 3.0 make the switch? Perhaps not – but we should urge him to try.

PS. As I posted this note on Substack, Fast Company, published an excellent profile of Waymo. Highly recommended.

Sentiment has cooled since December 2020, when Tesla traded at an unbelievable 940 times earnings.

Forecasts like this are invariably wrong. They cannot account for wide variances in how individuals commute, how much they drive, whether they use their vehicles commercially, how fast costs decline, unexpected events, etc. But the estimates look directionally accurate. The robotaxi market will be significant and disruptive.

Not investment advice. Ever.

Thank you, Marty!

These Tesla and anti-DOGE riots/protests are what happens when you can't win on law and ideas.

https://shorturl.at/FYDtt